REMA second stage consultation launched: an overview of the key aspects

By Kieran van Bussel, Mark Greatholder, Aliki Zeri, Colin Shear

14 Mar 2024 | 2 minute read

The Department for Energy Security and Net Zero (DESNZ) has released the second stage of its Review of the Electricity Market Arrangements (REMA) consultation.

Heralded by a number of press releases indicating an imminent shift to locational pricing and immediately preceded by Prime Minister Rishi Sunak's announcement of new gas plants, the second consultation round of documents released by DESNZ present a picture for sensible market reform measures, significantly in line with the expectations of industry participants and those engaging with the REMA process, despite the overshadowing of those more political statements.

The consultation paper organises the scope of REMA into four key challenges to be addressed:

"We have structured our thinking around four key challenges facing electricity markets, while also considering the interactions between these challenges given the need for an integrated, whole-system approach. These are:

- Passing through the value of a renewables-based system to consumers

- Investing to create a renewables-based system at pace

- Transitioning away from an unabated gas-based system to a flexible, resilient, decarbonised electricity system

- Operating and optimising a renewables-based system, cost-effectively"

Each of these four key challenges are then broken down into further proposals for this stage of the consultation. We have considered some of the key strands within the consultation below at a high level and will follow up with some "deeper dive" perspectives on some of these areas in the coming weeks.

Key strands within the consultation

The focus of many news articles in the day prior to launch of the stage 2 consultation was on the potential for locational pricing – indeed, the tone of various articles suggested that it had been decided that locational pricing would be adopted.

The consultation is, however, more nuanced than this, with locational signals (including zonal pricing and other forms of locational investment signals) and national pricing remaining as options. There is also consideration of reform of network charging and transmission access costs, which could also provide these locational signals.

Nodal pricing has been ruled out due to its likely detrimental impact on investor confidence and its potential to negatively impact decarbonisation targets.

Locational pricing, to be effective, would need to be accompanied by a reform of the planning and grid connections processes to ensure that projects are deliverable in the zones identified – this would likely be a more involved or longer-term process given the legal changes required (particularly to the planning process).

Given the current issues with the grid connection queue we think this might be difficult to deliver without significant impact to a number of projects currently in progress and we would be concerned with the impact this might have on developers with pre-construction assets.

Moreover, without the planning and grid reforms that would need to accompany a zonal pricing mechanism there is a risk a zonal policy would undermine its own objectives – discouraging investment in some areas due to low prices and making it almost impossible to develop in the others due to other barriers to development. There is also potential for a north/south divide along these lines.

Changes to the contracts for difference (CFD) scheme are also considered as part of the consultation. CFDs are seen as an effective tool for the encouragement of deployment of renewable power generation, helping to mitigate investment risk by providing an element of more stable long-term pricing as the market continues to develop.

DESNZ continues to back a CFD-type mechanism as a key tool for achieving the net zero targets, but notes that reform of the CFD is necessary to meet current challenges and make it fit for purpose into the 2030s.

Using a strike-price range or revenue cap and floor model have both been ruled out following the first consultation round, both options expressed as being more likely to result in a higher strike price and increased investor risk.

As part of the deeper and more detailed review of a narrower range of options at the second stage, REMA will consider the potential for a capacity-based or deemed CFD model rather than the current output-based model.

Both of these options have the potential to be beneficial if executed correctly and properly integrated with the rest of the wholesale market (including, for example, the introduction of any locational pricing system), although there are certainly a number of pitfalls that must be avoiding as part of any implementation.

The consultation also indicates a need for greater alignment between ancillary services and CFD auctions, particularly in relation to co-located installations – we anticipate greater levels of co-located projects coming online in coming years and additional steps to increase their viability will certainly be welcome. We also note that the proposed changes for AR7 are also intended to facilitate co-location.

On the capacity market (CM), the consultation focuses on continued use of the CM to deliver flexibility and security of supply. The paper suggests that the capacity market should be retained as the primary mechanism for delivering adequate capacity is available but introduce shorter term reforms to optimise the CM. Some of the key focus areas being taken forward in relation to the “Optimised CM” are:

- A single auction with multiple clearing prices

- Introduction of a minimum procurement target for desirable characteristics (such as low-carbon technologies or specific flexibility capabilities)

- Introduction of capacity markets emissions limits (although noting that this will not take place until the 2026 CM auctions at the earliest)

Discounted options include a cross-technology revenue and floor cap, centralised reliability options, introduction of a strategic reserve and use of a supplementary targeted tender system.

In addition, the consultation paper highlights a desire to move away from using bespoke support schemes for particular technologies in favour of allowing technologies to participate in the Optimised CM as soon as possible and allowing the market to identify the most cost-effective technologies.

It is acknowledged that certain technologies will require bespoke support for longer – for example CCUS (carbon capture, usage and storage) and H2P (hydrogen to power) schemes, and that a bespoke scheme for long duration energy storage (LDES) should be implemented (there is currently a separate ongoing consultation underway in relation to this).

Key to the success of any Optimised CM will also be the weaving in of LDES, including longer duration battery technology and other forms of long-duration storage. The market for these technologies remains nascent with no clear winners in terms of the optimal technological solution, and as renewable penetration increases the necessity of longer-term low-carbon flexibility services will become more prominent.

In relation to new gas plants, the DESNZ analysis indicates a limited amount of new-build gas capacity will be required in the near term, as the only mature technology currently capable of delivering sustained flexible capacity, while alternatives are being developed and scaled. It would be a shame to see unabated gas generation used as a convenient alternative to providing appropriate support to low-carbon alternatives and thereby dilute the net-zero 2035 commitments.

Other points of interest

In addition to the items above, there are a number of other points of interest (and no doubt more in the finer detail, which we hope to comment on once we have been able to fully digest some of the supporting materials). These include:

- Monitoring of the corporate PPA market – this is an area that we have seen grow significantly over recent years, and we expect further growth and development as renewable generation increases and power prices available on the wholesale markets decrease. The reference to this in the consultation comes alongside discussion of the CFD – development of this market could help reduce reliance on CFD and similar support mechanisms by providing stable long-term contracting to generators.

- Incentivising demand reduction – the consultation is considering demand reduction in the context of whole system value, including strengthening price signals in electricity and retail markets (e.g. pricing, incentives). This could involve tackling consumer behaviour, which would be a challenge, but there are certainly available gains here that may be delivered by technological solutions and help deliver flexibility.

- Reform of the balancing mechanism and shorter settlement periods –shorter settlement periods have been called for from a number of quarters in relation to the balancing mechanism and this would likely be a favourable change for those able to participate.

- Centralised dispatch vs self-dispatch – centralised dispatch remains an option. It is not clear how this might be delivered in practice and there will likely be concern amongst some asset classes (in particular storage) about how this would work and the impact it might have.

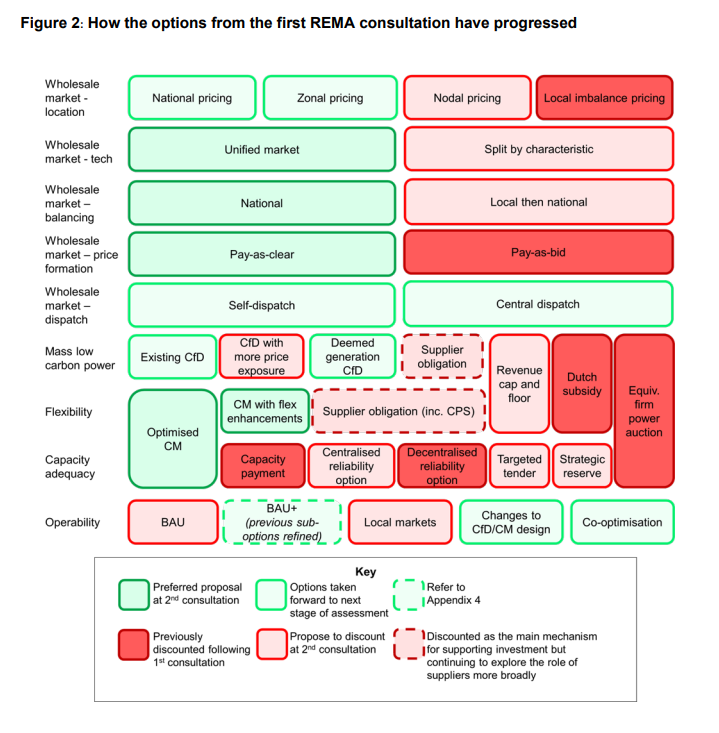

Diagram – scope of the consultation

The diagram below shows those matters in the original REMA scope and the position as at the second round of the consultation, including those elements discounted and those being taken forward.

Get in touch

Our Clean Energy team advises clients on legal issue across the various matters within the scope of REMA. Please get in touch with us if you would like to discuss any of the points in this article, we would be delighted to hear from you.