Principal Director

Energy & Infrastructure | Projects, Infrastructure & Construction | Real Estate

This website will offer limited functionality in this browser. We only support the recent versions of major browsers like Chrome, Firefox, Safari, and Edge.

To celebrate the publication by the Joint Contracts Tribunal of the newest member of its family of standard form construction contracts – the JCT Target Cost Contract 2024 – we have produced two briefing notes on "target cost" contracting in the context of the UK construction industry.

This is the second of these briefing notes, which focuses specifically on the publication (and structure) of the JCT Target Cost Contract 2024 itself.

The first briefing note, which discusses what target cost contracts are and how they work generally can be found here.

After a long drumroll, the Joint Contracts Tribunal ("JCT") has now raised the curtain on the newest member of its family of standard form construction contracts – the JCT Target Cost Contract 2024 ("JCT TCC") – along with an accompanying sub-contract form and guidance notes.

Whilst the "Constructing Excellence" form, which has been part of the JCT suite for almost 20 years, facilitates a target cost pricing model (along with a lump sum model), it is not as commonly used as other JCT forms for whatever reason (possibly because it looks and feels very different to the more traditional "construction contracts" in the suite). So, the publication of a dedicated target cost contract is a huge step forward for JCT.

To say that the arrival of the JCT TCC has been highly anticipated – especially in the real estate, housing and development sectors, as well as the wider public sector – is an understatement. It has been a long time coming, but how does it stack up? Let's find out…

Helpfully, the JCT TCC follows the approach taken by other common standard form target cost contracts (e.g. NEC and ICC), in that the core terms of the JCT TCC are almost identical to the suite's current "design and build" form, but with a reworked pricing mechanism and alternative "change" mechanism (see our previous comments on the JCT Design & Build Contract 2024 here). As with the "design and build" form, the JCT TCC is designed for use on both public sector and private sector projects where the contractor is required to complete the design of the works.

So, rather than parties (and their professional teams) having to get to grips with very different-looking contract terms (which was previously the case with the above-mentioned JCT Constructing Excellence Contract), seasoned JCT users will have the benefit of familiarity with how the core terms of the contract operate on a day-to-day basis (e.g. specification and completion requirements, time and money claims, variations / changes, defects rectification, insurance profiles etc.). They will just need to take time to understand how the new target cost pricing mechanism operates, noting that JCT's standard "Construction Act" payment process still underpins everything.

This familiarity will help users massively with contract management, particularly from the perspective of employer's agents, and is one of the reasons why the main "construction and engineering" forms of NEC contract have been so popular in the market since their publication – the terms of each are almost identical save for pricing option-specific changes.

At its core, the JCT TCC follows a typical target cost structure, but with a twist.

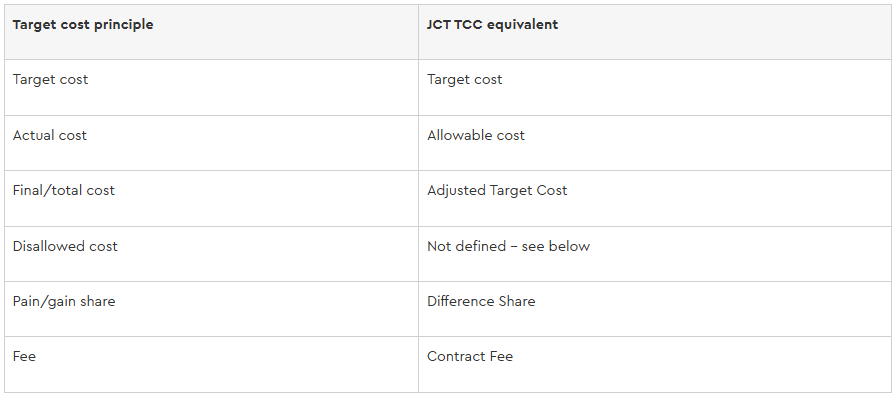

To start with, the JCT TCC uses its own contract-specific terminology (with these terms being used in the remainder of this briefing note for ease of reference):

As with fixed cost contracts, target cost contracts include a "day one" breakdown of the target cost in a pricing document (e.g. the "Activity Schedule" or "Bill of Quantities" in the NEC forms). These provide the anchor point for assessing the actual and final cost of the works against the original target cost, as well as adjustments to the target cost to account for the impact of things such as delay events.

This is no practical difference under the JCT TCC.

The day one "Target Cost" is specified upfront in the "Articles" section of the JCT TCC, following the approach taken in the "design and build" form where "Contract Sum" is used.

The contractor is also required to provide a "Target Cost Analysis" on day one to substantiate the "Target Cost", along the same lines as the "Contract Sum Analysis" in the "design and build" form. This document is identified in the "Contract Particulars" section of the contract.

Note that, when calculating the "Target Cost" under the JCT TCC, it is inclusive of the "Contract Fee" (discussed below). Parties should ensure that they are clear at the outset as to the basis upon which any eventual pain/gain assessment will be calculated, as the "Contract Fee" will be taken into account as part of such assessment.

Under the JCT TCC, "Allowable Cost" is cost that the contractor can demonstrate that it has properly incurred in carrying out and completing the works by reference to pre-agreed classes of costs. The costs that are recoverable by the contractor are determined by reference to Schedule 2 (Allowable Cost) and the "Contract Particulars" of the contract.

Schedule 2 (Allowable Cost) is comprised of 7 parts and covers:

This schedule functions in a similar way to the "Schedule of Cost Components" in NEC target cost contracts ("Option C" and "Option D") in that it defines the specific types of cost that the contractor can include in its applications for payment (and for which it is entitled to be reimbursed).

Whilst the JCT Design & Build Contract 2024 (as with previous editions) has a section entirely dedicated to changes in / variations to the scope of the works, with an associated valuation mechanism, the JCT TCC takes a different approach. Instead, a list of items that will constitute a change / variation is set out in the contract terms, albeit in a different place to its "design and build" counterpart, but the valuation of any change / variation is now assessed through this Schedule 2 (Allowable Cost), reflective of the fact that the contractor will be paid on an "actual cost" basis.

Schedule 2 (Allowable Cost) can also be supplemented by further details in the "Contract Particulars", which allows for the list of items to be adjusted as required to reflect project-specific requirements.

Such costs still need to be substantiated by invoices and internal accounting information in the usual way but, generally speaking, any costs that fall outside of the permitted classes of cost identified in Schedule 2 and the "Contract Particulars" will automatically be "disallowed" (see below).

As is the case with its NEC cousin, Schedule 2 (Allowable Cost) and the associated "Contract Particulars" entry should be reviewed and updated on a project-specific basis to ensure that it properly reflects the agreed cost recovery (and exclusion) profile for the relevant project.

In general terms, the employer can "disallow" costs that are claimed by a contractor as part of its interim payment applications and as part of the final account process under the JCT TCC, both of which follow processes similar to those set out in the JCT Design & Build Contract 2024.

Unlike its NEC equivalents, the JCT TCC does not include a dedicated definition of "Disallowed Cost". Instead, any sums that are not covered by the definition of "Allowable Cost" are, by extension, not recoverable by / payable to the contractor (i.e. they are disallowed in the wider sense).

The assumption is that, where the parties agree that certain sums will not be payable to the contractor, the Allowable Cost schedule (as mentioned above) will be updated through the "Contract Particulars" to address this.

Due to the impact on contractors of costs being disallowed on construction projects (as well as the potential exposure of employers to unanticipated costs), it is expected that, in the absence of an express definition, the relevant schedule will be subject to negotiation on a project-specific basis.

The "Target Cost" can be adjusted in a similar way to which the "Contract Sum" is adjusted in other JCT forms. The means by which the "Target Cost" can be adjusted is set out at Schedule 1 (Adjusted Target Cost) of the JCT TCC and, under three separate parts, broadly covers:

Under the JCT TCC, the "Contract Fee" (broadly, the contractor's profit and overhead percentage for carrying out and completing the works) can either be:

This "Contract Fee" is specified upfront in the "Contract Particulars" section of the JCT TCC (again, following the approach taken in other JCT forms of contract).

Where a fixed "Contract Fee" applies, the JCT TCC allows the parties to agree that the fixed amount can be adjusted in certain circumstances to take into account the difference between the original Target Cost and the final Adjusted Target Cost, based on a pre-agreed percentage-based threshold (e.g. where the difference between the two is greater than X%). This allows the parties to agree a commercial risk share in relation to the fixed "Contract Fee", but the percentage can be expressed as zero percent (i.e. no adjustment will apply). A formula that sets out the basis upon which such adjustment will be made is set out at Schedule 3 (Adjustment of Contract Fee) of the JCT TCC, with the parties needing to specify the percentage threshold in the "Contract Particulars".

The second percentage-based option above is common in the current market thanks to its use in NEC forms of target cost contract.

As mentioned in our Introduction to Target Cost Contracts article, under a target cost model, any:

against the original target cost for the works (as updated to take into account any previous adjustments owing to delay events and variations etc.) is shared between the parties in pre-agreed proportions. This is generally known as the "pain / gain share".

The JCT TCC utilises a similar mechanism and the contract assumes that, depending on the preferred approach, one or more assessments will be made to determine what it calls a "Difference Share" (i.e. the "pain" or "gain" to be shared between the parties).

The basis on which the "Difference Share" will apply is set out in the "Contract Particulars" section of the contract at the outset, in tabular form, and can either be expressed as agreed percentages (similar to the approach that the NEC target cost forms adopt) or by reference to pre-agreed financial amounts.

It is important to note that, when making any such assessment under a JCT TCC, the "Contract Fee" will be factored in (i.e. the "Target Cost" should include an allowance for the "Contract Fee" on day one). This is not always the case in other forms of target cost contracts.

The JCT TCC allows, through the "Contract Particulars", this assessment to be undertaken in two different ways:

Assessment on an on-going/interim basis

Here, assessments are made as part of the "interim payment" process under the contract (which follows the same "Construction Act" approach as other JCT forms).

The "Difference Share" is determined by applying the "Allowable Cost" plus "Contract Fee" against the "Adjusted Target Cost Value of Work Completed" as at the date of the interim assessment (i.e. the "Target Cost" as adjusted – see above).

Whilst this approach may be considered administratively burdensome, the main benefit to it is that the cost for the works is continually assessed so that, in theory, any potential overspend is identified (and managed) as soon as possible, rather than being dealt with at the final account stage – see below.

Final assessment

Here, the assessment is made as part of the final account process (i.e. after completion of the works).

The "Difference Share" is determined by applying the "Allowable Cost" plus "Contract Fee" against the "Adjusted Target Cost" for the whole of the works as at the date of the assessment (i.e. the "Target Cost" as adjusted – see above).

So, to the extent that the contractor exceeds the "Target Cost" relatively early in the construction stage of the works, it will continue to be paid in the normal way and the employer will need to seek to recover such costs from the contractor at the end of the project, which may be difficult practically depending on the value of any overspend (see below).

A word of caution

Unlike other forms of target cost contract, the JCT TCC includes a default sharing proportion that will apply unless modified, which is consistent with the approach taken across the JCT suite of contracts for "fill the blanks" (project-specific) items. The standard position is that the pain/gain share will apply by reference to percentages and the "Contract Particulars" section includes a default position that will apply unless stated otherwise – 50:50. As such, it is critical that this section is updated on a project-specific basis.

Whether the JCT TCC will challenge its NEC equivalent for the title of most used target cost contract in the UK remains to be seen. However, the introduction of a dedicated target cost form is undoubtedly a substantial step forward for the JCT suite and is understandably likely to result in an increased interest in the contracting model for those organisations and sectors that have historically preferred and used JCT over other standard forms.

What does this mean?

Well, for those familiar with target cost contracting, JCT has put its own stamp on the JCT TCC, so care should be taken to ensure that all parties understand the JCT-specific structure and idiosyncrasies of the form, as well as the key differences from other standard forms such as NEC.

For those less familiar with the contracting model, whilst the JCT TCC looks and feels very much like the "old faithful" JCT forms, care should be taken to ensure that all parties and their professional advisers fully understand the way in which target cost contracts work, as well as recognise the level of day-to-day involvement (particularly from a contract administration perspective) and collaboration that is required to ensure that a project is delivered successfully using the form.

Please get in touch if you would like to speak to one of our sector experts about the ins and outs of target cost contracting and the pros and cons of using the contracts on your projects, as well as on anything construction and infrastructure-related generally.