The Charities Act 2011: The next tranche of changes

By Anna Phillips, Andrew Mackie

9 Mar 2023 | 5 minute read

On 31 October 2022, ten sections of the Charities Act 2022 came into effect, bringing about a number of technical but nonetheless useful changes to the Charities Act 2011. In this article, we provide an overview of the main changes that will come about when the next set of provisions come into force this Spring (on a date yet to be announced).

Changes to the rules relating to permanent endowment

Permanent endowment is property held by a charity that cannot be spent as if it were income; instead, the property must be retained as capital and either used to further the charity's purposes ("functional" permanent endowment, such as a village hall) or to produce an income, with only the income being expendable on the charity's purposes ("investment" permanent endowment, such as cash or shares). In many cases, the restriction on expenditure of capital has been created by the donor, who may have wanted assurance that the gift would have lasting value. Generally, permanent endowment can only be sold if the proceeds will be used to buy replacement permanent endowment.

Since the Charities Act 2006 came into force, the law has allowed charities to spend investment permanent endowment as if it were income in certain circumstances – sometimes, but not always, with the prior consent of the Charity Commission. The provisions coming into effect in the Spring will simplify these powers, as well as making them more widely available by altering the threshold beyond which Commission consent becomes necessary. They will also reduce the amount of time the Commission has to respond to consent requests, with charities being able to treat consent as forthcoming if the Commission has not raised an objection within 60 days. In addition, trustees will be given a power to "borrow" up to 25% of the value of their permanent endowment, provided that the amount will be repaid to the fund within 20 years. This will enable them to spend the money on projects in furtherance of the charity's objects without having to seek funding from potentially more expensive sources.

A further change, which will only apply to charities that have opted in to investing on a total return basis, will bring about greater flexibility for investing permanent endowment in social investments by introducing a new power to do so where there is an anticipated negative financial return.

Charity names

The Spring changes will also give the Charity Commission enhanced powers to require charities to change, or stop using, names that it deems to be unsuitable. The enhanced powers will apply to charities' working names, as well as their formal names. A working name is a name other than its formal name that a charity uses to label itself – perhaps the best-known example being "Comic Relief", which is in fact a working name of the charitable company Charity Projects.

Under section 42 of the Charities Act 2011, the Charity Commission can already direct a charity to change its formal name in five sets of circumstances: if the name is offensive, for example, likely to mislead the public as to the charity's purposes, or too similar to that of another charity. Once expanded, the power will also apply to working names. Consequently, as well as being required to change its formal name, a charity might also be directed to stop using one or more working names (although this would not preclude it from using alternative working names, provided of course that they were deemed suitable).

Charity land

A significant number of the provisions of the 2022 Act coming into effect in the Spring relate to charity land. The key headlines for charities to be aware of are as follows:

Dispositions

The circumstances when a report is required in line with s.119 Charities Act 2011 (known as a 's.119 Report') have been limited. From the date on which the changes are implemented, a report will only be required by law if the whole of the land being disposed of is held either:

- By a single charity solely for its own benefit (not on behalf of or in trust for another person).

- On trust solely for a single charity

The amendments provide clarity that where land is appropriated to more than one charity (and, as was always the case, a mixture of charities and non-charity beneficiaries), a s.119 Report is not required by law. A report, may of course, still be desirable and may assist in maximising the sale value achieved.

It is important to note that although, following amendment the requirement of a s.119 Report is only required where the whole of the land disposed of is held by or for a single charity, the requirement would still apply where a part / share of land is appropriated to a single charity and is to be disposed of separately to the remainder.

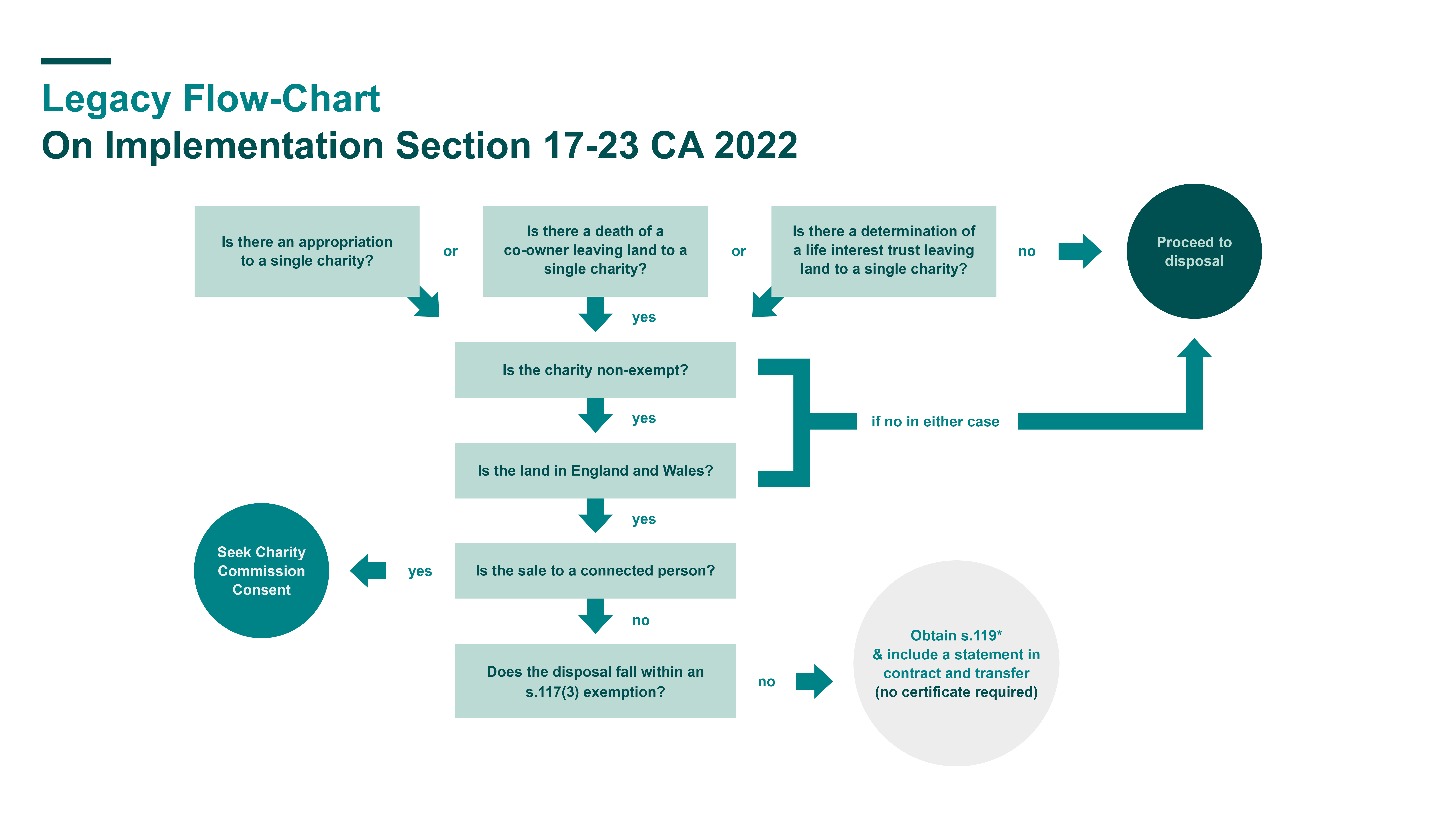

The flowchart below summarises the steps to consider where there is a disposal of land as part of an estate administration.

Residential Tenancies and Connected persons

The definition of "connected persons" will now exclude the grant to employees of residential tenancies of less than one year. This will allow charities to grant tenancies to their staff as a matter of expediency without the need to obtain Charity Commission consent for example in areas where housing prices are high.

The changes also remove long outdated reference to Illegitimate children. However, despite, consideration the removal of trading entities from the of connected persons, this change was not enacted. Rather, the Charity Commission opposed this change on the basis it is important for charities to remain alert to the need to ensure transactions with trading subsidiaries are progressed on an 'arms' length basis' and with the charity's best interest being paramount.

Exemptions

Minor changes will also take effect to exemptions from the requirement to obtain a s.119 Report including:

- Sales by liquidators, administrators, receivers and mortgagees which are subject to separate duties to obtain best value on disposal of properties.

- Dispositions by universities and college which are now brought into line with other charities.

Obtaining Advice

The new provisions will also provide more flexibility and streamlining around how charities obtain advice on disposals of land, including:

- The replacement of 'qualified surveyors' with 'designated advisers'- broadening the scope of this definition to include internal advisors and a wider range of external advisors including members of the Central Association of Agricultural Valuers and National Association of Estate Agents.

- Removing the specific requirement to advertise in line with recommendations provided in valuation reports.

Watch this space for the date of implementation of the above changes!

A further tranche of changes is due in the Autumn, which we will deal with in a future article. In the mean time, find out more about our charity solicitors can help.