This is important for port operators because the new regime gives the UK government powers to scrutinise and intervene when it comes to investment in ports by overseas investors or from within the UK.

Port operators of all descriptions should be aware of this development for two main reasons:

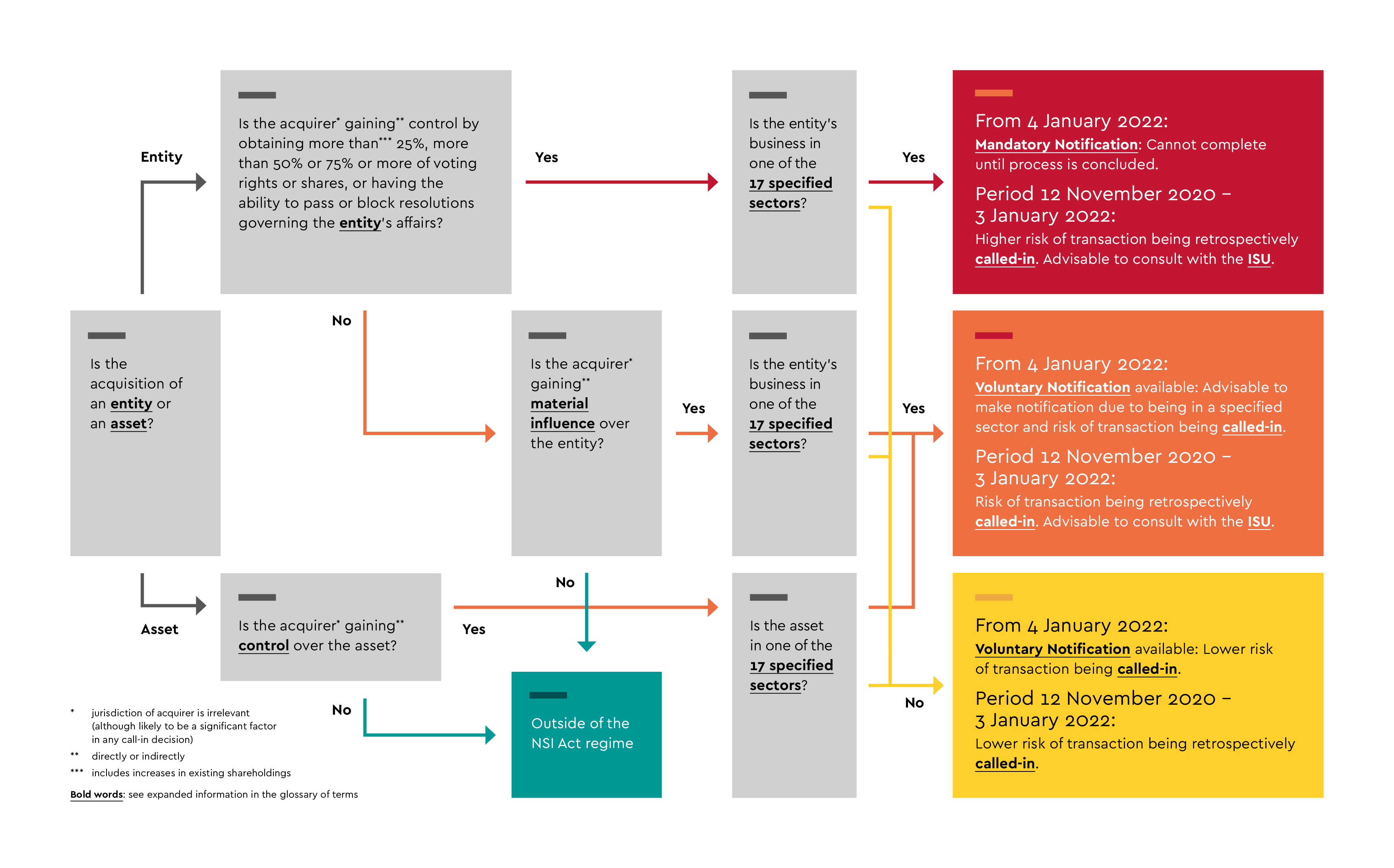

- Transport is one of the 17 sectors of the economy within the mandatory notification regime under the NSI Act. This means there is a higher risk that mandatory notification will be required. This in turn means that if the entity owning or controlling a port is the subject of a qualifying transaction then that transaction will be caught by the notification requirements.

- The NSI Act applies widely; for example, it covers entities carrying on activities within a sea port. In our view it would be prudent for operators to have in their mind the regulatory and legal framework that will apply to any such transaction and recognise the increased level of government intervention on the horizon.

- Satellite and space technology is expressly included as a sector in its own right.

We consider the NSI Act’s scope in more detail below:

Ports and Harbours

Activities carried out by a qualifying entity here consist of:

- Owning or operating a port or harbour in the United Kingdom that handled 1 million tonnes or more of cargo as recorded in the Port Freight Annual Statistics in the year preceding the year in which the acquisition is due to be completed; OR

- Owning and operating terminals, wharves or other infrastructure situated in a port or harbour described above.

The above definition would include the 51 major ports within the UK.

In our view the key point here is that the mandatory notification regime in the NSI Act applies to an entity which owns or operates – “operating” is defined in the draft statutory instrument as “controlling the functioning of the port, harbour, terminal, wharf or other infrastructure”. Infrastructure means “infrastructure, facilities and equipment within a port or harbour directly related to the movement of freight, passengers or seafarers”.

So, the scope for intervention is wider than only the entity which owns the port. The UK government will pay close attention to investment being made into your port in a qualifying transaction and could potentially veto such investment altogether on national security grounds.

Airports

Activities in relation to airports are included in the draft statutory instrument as part of the transport sector. The question here is whether the qualifying entity’s activities consist of or include:

- Owning or operating an airport in the UK that handled at least 6 million passenger movements or 100,000 tonnes of freight in 2018;

- Providing en route air traffic control services in the UK; and

- Owning a provider of en route air traffic control services in the United Kingdom.

Looking at pre-pandemic passenger data, this would affect 10 UK airports and would, of course affect national air traffic services.

Space Ports

Activity in this rapidly developing sector is also subject to the mandatory regime of the NSI Act.

Here the question is whether the qualifying entity carries on activities that include operating, developing, producing creating or using facilities including:

- Management of debris in outer space;

- ‘In orbit’ servicing or maintenance or manoeuvring of satellites;

- Provision of satellite communication links;

- Operating or maintaining the capability of secure infrastructure related to space or sub orbital activity;

- Manufacture or testing of space craft, launch vehicles or satellites including ground support equipment;

- Operation or control of infrastructure.

- Use of space-derived data for a defence purpose

- Provision or processing of space situational awareness data for sub-orbital activity, orbital activity, or a defence purpose.

Operators and downstream businesses will appreciate the relatively wide definition of the activities in this sector and operators will need to consider the implications of the NSI Act on the chosen legal structure for the operation.

How can Foot Anstey help?

Foot Anstey’s lawyers have experience of working with ports of all shapes and sizes.

We know how important it is for ports to work together to understand issues that affect the transport infrastructure sector overall. These ports are many and varied, and of great importance given that they are a gateway into the UK and of critical commercial and economic importance.

This recent legislative development is likely to require significant attention when it comes to investing in ports in the UK and there is no doubt that the NSI Act has the potential to give far greater powers to the UK government to affect investment decisions into your port, to the extent that they consider such investment to impact national security.

Spaceport operators will need to pay close attention to the NSI Act too given the breadth of activities that feature within the legislation and the complex questions that arise into the bargain